43 how to find the coupon payment

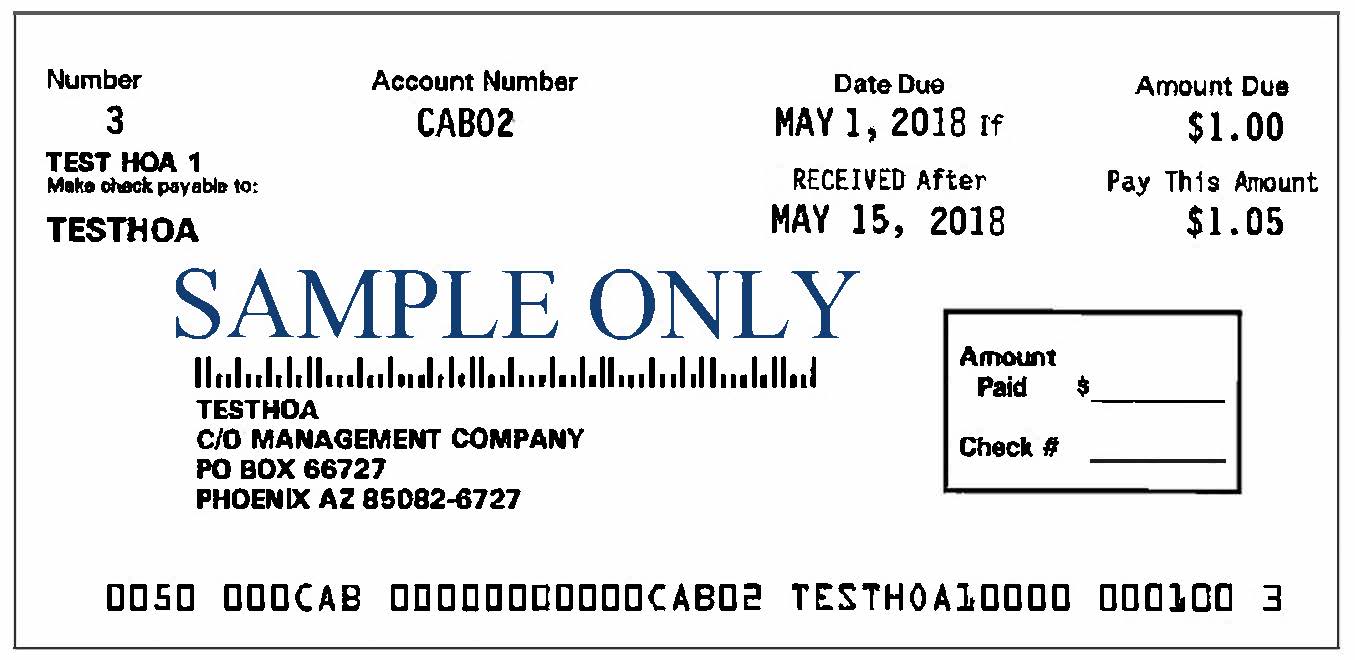

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Loan Payment Coupon Book Alternatives - The Balance Your payment coupons just need some basic information to make sure that your payment gets credited properly. Make sure the following items are included in your coupon: Your name and address Your contact information (especially a phone number to call if there are any questions about your payment) Your account number with the lender

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

How to find the coupon payment

How to Calculate a Coupon Payment | Sapling After you've calculated the total annual coupon payment, divide this amount by the par value of the security and then multiply by 100 to convert this total to a percent. Remember the equation: coupon rate formula = (total annual coupon payment) divided by (par value of the security) x 100 percent. Advertisement Coupon Rate Formula Examples How Can I Calculate a Bond's Coupon Rate in Excel? In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments... Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50

How to find the coupon payment. Coupon Definition - Investopedia Coupon rate or nominal yield = annual payments ÷ face value of the bond Current yield = annual payments ÷ market value of the bond The current yield is used to calculate other metrics, such as the... Microsoft Excel Bond Valuation - TVMCalcs.com The purpose of this section is to show how to calculate the value of a bond, both on a coupon payment date and between payment dates. If you aren't familiar with the terminology of bonds, please check the Bond Terminology page. If you aren't comfortable doing time value of money problems using Excel, you should work through those tutorials ... How to Calculate a Coupon Payment: 7 Steps (with Pictures) 7 steps1.Get the bond's face value. The first piece of information is the actual face value of the bond, sometimes called its par value. Note that this value might ...2.Locate the bond expiration. You'll also need to locate the bond expiration or maturity date. That way, you can get a sense of how long you'll be receiving ...3.Find the bond coupon rate. The coupon rate is usually expressed as a percentage (e.g., 8%). You'll need this information, also provided by your broker, to ... How to Calculate the Price of a Bond With Semiannual Coupon Interest ... To convert this to a coupon payment, or the amount of money you'd actually receive each period, multiply the face amount of the bond by the required rate of return. Continuing with the example, if the face value was $1,000, you'd multiply it by 0.025. This results in a semiannual payment of $25. Discounting Future Payment to Present Values

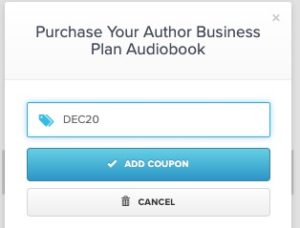

Coupon payments remaining until maturity - MATLAB cpncount Date when a bond makes its first coupon payment, specified as a serial date number, date character vector, or datetime array. FirstCouponDate is used when a bond has an irregular first coupon period. When FirstCouponDate and LastCouponDate are both specified, FirstCouponDate takes precedence in determining the coupon payment structure. If you do not specify a FirstCouponDate, the cash flow ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. Groupon 101: Help on Promos, Payments & More Click on "Promo or Gift Code" under "Order Summary," type in the promo, and press "apply." If your promo code isn't working, it could be because of the following: Promo codes are case-sensitive. Make sure your code is upper case. Some promos are specific to a type of deal (for instance: restaurants, beauty/spa, travel, etc.). How to Calculate Present Value of a Bond - Pediaa.Com Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond. F = Face value of the bond. R = Market. t = Number of time periods occurring until the maturity of the bond.

Answered: t20 years, find the coupon payment,… | bartleby Solution for t20 years, find the coupon payment, redemption value, purchase price and bond premium. (Bond Valuatio How to Calculate an Interest Payment on a Bond: 8 Steps Find the monthly interest. If the bond pays monthly, the exact same approach as above would be used, but the $50 would be divided by 12, since there are 12 months in a year. In this case, $50 divided by 12 is $4.16, which means you would receive $4.16 monthly. You earn the interest only for the days you own the bond. Find the coupon date of a bond - Stack Exchange 1 It will pay periodic coupons starting from the issue date. You can also work backwards from the maturity date. In your example the bond matures on March 6, 2022 and pays interest annually (although I find conflicting data from other sites) so it pays interest every March 6th (plus or minus a few days depending on what the prospectus says). Calculate the Interest or Coupon Payment and Coupon Rate of a Bond This Excel Finance tutorial shows you how to calculate the present value or price of a bond that has semiannual or quarterly interest (coupon) payments. This is similar to calculating the price of an annual bond except that you have to alter the particular details of the bond to take into account the multiple payment periods per year.

Coupon Payment | Investor.gov Coupon Payment. The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value. Featured Content. Investomania! Don't play games with your financial future. Learn how you can avoid getting caught up in game-like investing.

Coupon Payment | Definition, Formula, Calculator & Example Coupon payment for a period can be calculated using the following formula: Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate - Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Below are the steps to calculate the Coupon Rate of a bond:

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check.

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Where to Find Online Coupon Codes and Discover Hidden Discounts When you're ready to check out, open a new browser window to search for online coupon codes. Search the name of the company and "coupons," "coupon codes" or "discount codes." I used the latter when looking for that Western Union code. In the search results, you'll often find websites that have a dozen or more codes to try.

How to Calculate the Price of Coupon Bond? - WallStreetMojo The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity.

How to Calculate the Bond Duration (example included) m = Number of payments per period = 2 YTM = Yield to Maturity = 8% or 0.08 PV = Bond price = 963.7 FV = Bond face value = 1000 C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for semiannual bond you'll have a total of 4 coupon payments (one payment every 6 months), such that: t1 = 0.5 years t2 = 1 years

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50

How Can I Calculate a Bond's Coupon Rate in Excel? In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments...

How to Calculate a Coupon Payment | Sapling After you've calculated the total annual coupon payment, divide this amount by the par value of the security and then multiply by 100 to convert this total to a percent. Remember the equation: coupon rate formula = (total annual coupon payment) divided by (par value of the security) x 100 percent. Advertisement Coupon Rate Formula Examples

![Black Hobbyhorse [Video] | Hobby horse, Hobby horses, Horses](https://i.pinimg.com/736x/c6/73/b6/c673b6bcb4e3f23c8946416aafb787d5.jpg)

Post a Comment for "43 how to find the coupon payment"