39 coupon value of a bond

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3. Coupon Definition - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value, both of...

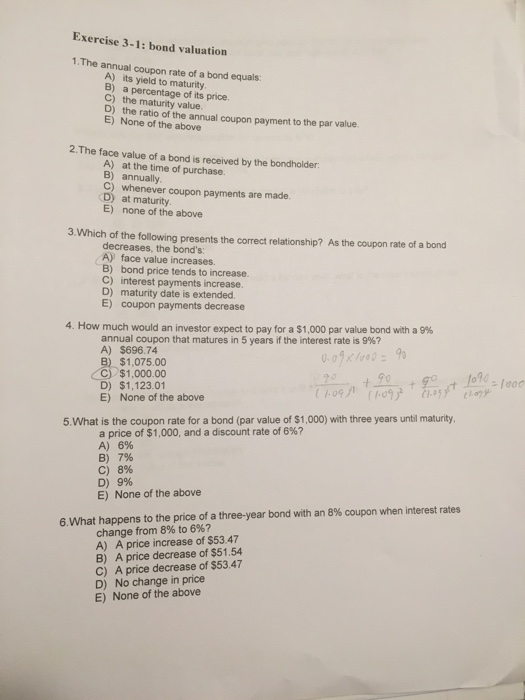

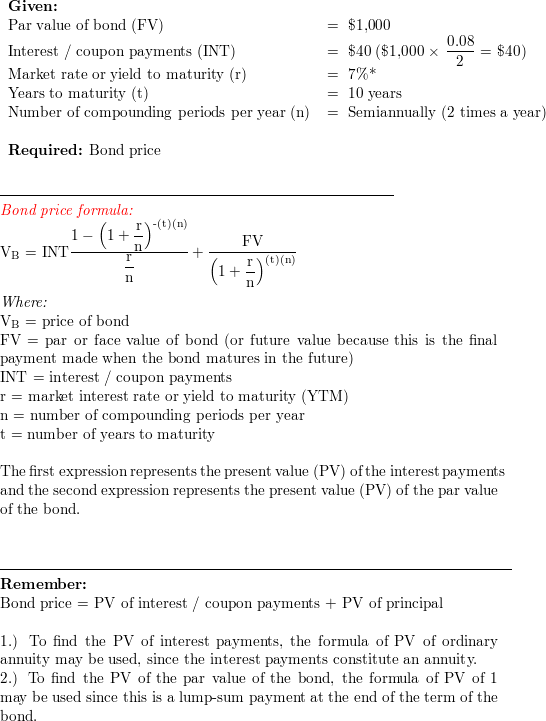

Coupon Payment | Definition, Formula, Calculator & Example Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator.

Coupon value of a bond

What is the Coupon Rate? | IIFL Knowledge Center A coupon rate is the rate of interest paid on the face value of a bond, by the issuer, to the bondholder. For instance, if the 5-year bond with a face value of Rs. 100 is traded in the market at ... Coupon Rate: Formula and Bond Nominal Yield Calculator [Excel Template] The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

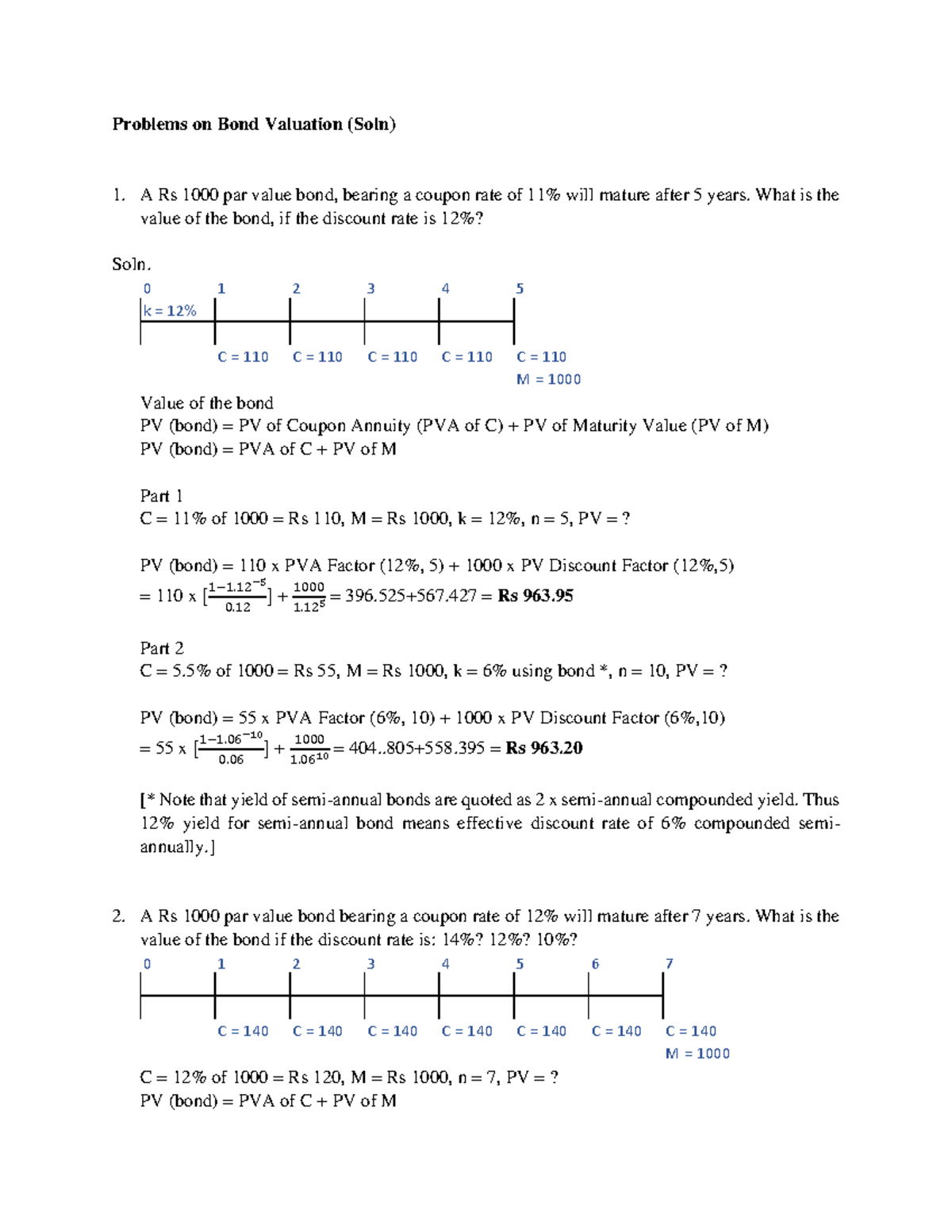

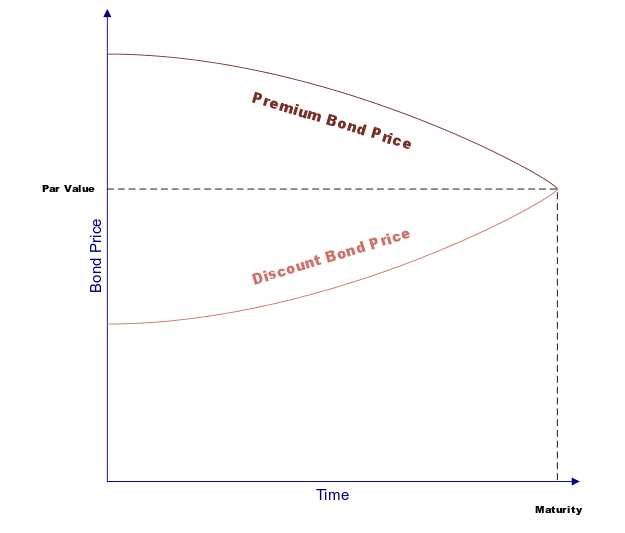

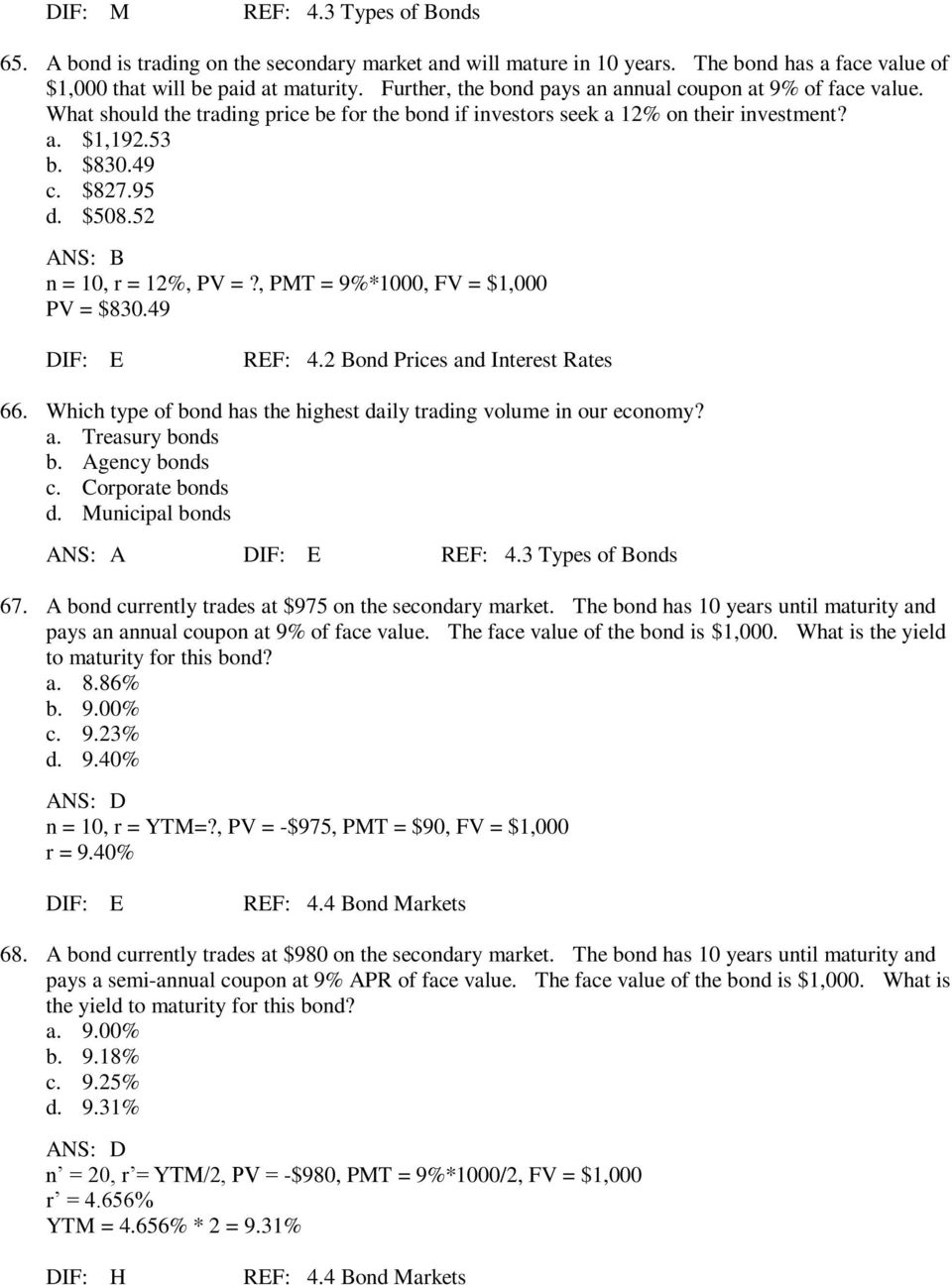

Coupon value of a bond. Bond Valuation Formula & Steps | How to Calculate Bond Value - Video ... For example, find the present value of a 5% annual coupon bond with $1,000 face, 5 years to maturity, and a discount rate of 6%. You should work this problem on your own, but the solution is ... How to Calculate the Price of Coupon Bond? - WallStreetMojo It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Solved If a bond with face value of \( \$ 1,000 \) and a | Chegg.com If a bond with face value of $1, 000 and a coupon rate of 7% is selling at a price of $1, 060, is the bond's yield to maturity more or less than 7%? Previous question Next question COMPANY Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

GOI LOAN - Bond Price, Yield Percentage, Coupon Rate | IndiaBonds The simplest way to calculate a bond yield is to divide its coupon payment by the face value of the bond. This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the ... What Is the Face Value of a Bond? - SmartAsset A bond's coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond's face value on its maturity date. Bonds are generally considered safer investments than equity investments (stocks). But as with any investment, nothing is a sure bet. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. What Is a Coupon Rate? And How Does It Affects the Price of a Bond ... Every year it pays the holder $50. To calculate the bond coupon rate, total annual payments need to be divided by the bond's par value. Annual payments = $ 50. Coupon rate = $500 / $1,000 = 0.05. The bond's coupon rate is 5 percent. This is the portion of bond that shall be paid every year.

Coupon Rate Structure of Bonds — Valuation Academy 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40) each year for 6 years and the par value ($1000) at the end of 6 years. Coupon Bond - Investopedia Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Zero coupon bonds do not pay interest throughout their term. Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. ... Enter the face value of a zero-coupon bond, the stated annual percentage rate (APR) on the bond and its term in years (or months) and we will return both the upfront purchase ...

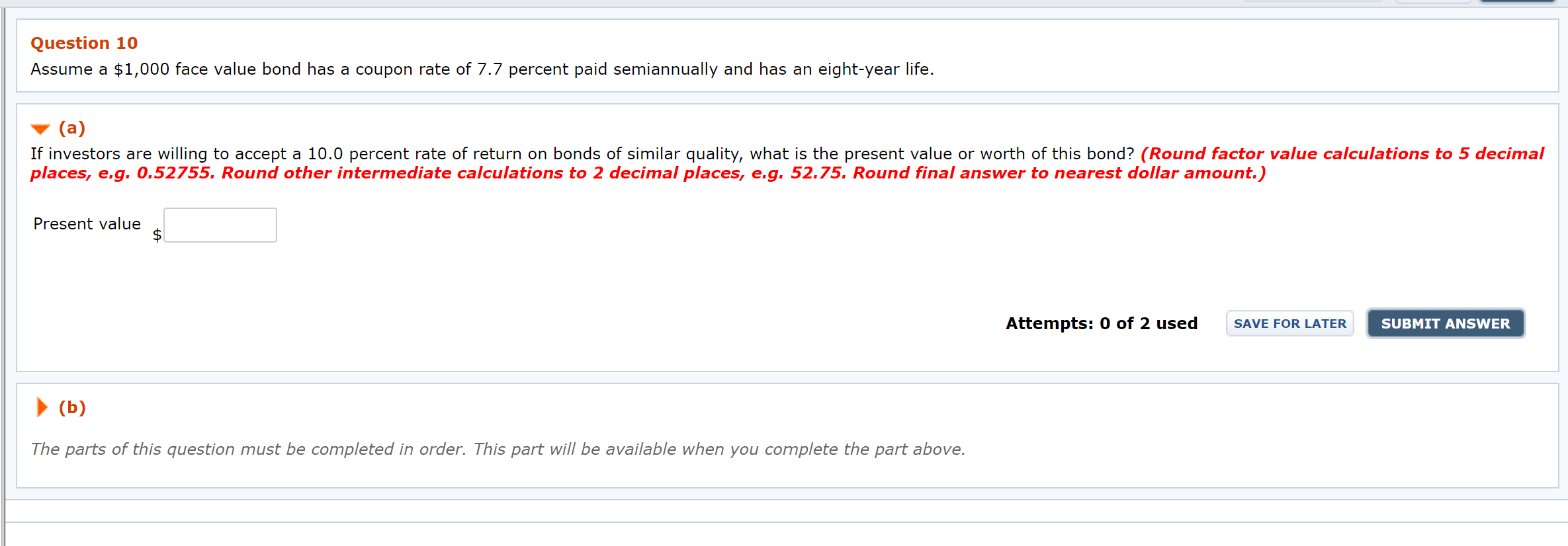

Calculate the Value of a Coupon Paying Bond - Finance Train The value of a coupon paying bond is calculated by discounting the future payments (coupon and principal) by an appropriate discount rate. Suppose you have a bond with a $1,000 face value that matures 1 year from today. The coupon rate is 12% and the bond makes semi-annual coupon payments of $60. The bond yield is 13%.

Bond Valuation: Formula, Steps & Examples - Study.com Bond Terms. Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%.

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

Bond coupon rate calculator - ShamleeAeden N Coupon rate compounding. Bond prices are subject to change. Use the simple annual coupon payment in the calculator. This is due to the coupon rates and risks associated with the bond. In order to calculate YTM we need the bonds current price the face or par value of the bond the coupon value and the number of years to maturity.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Coupon (finance) - Wikipedia Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total coupons of $50 per year.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The amount of interest is known as the coupon rate. Unlike other financial products, the dollar amount (and not the percentage) is fixed over time. For example, a bond with a face value of $1,000 and a 2% coupon rate pays $20 to the bondholder until its maturity.

Calculation of the Value of Bonds (With Formula) - Your Article Library Bond valuation strategies are further illustrated to clarify bond valuation. Illustration 1: Find present value of the bond when par value or face value is Rs. 100, coupon rate is 15%, current market price is Rs. 90/-. The bond has a six year maturity value and has a premium of 10%. If the required rate of returns is 17% the value of the bond ...

How to Calculate Present Value of a Bond - Pediaa.Com Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond Step 2: Calculate Present Value of the Face Value of the Bond

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon Rate: Formula and Bond Nominal Yield Calculator [Excel Template] The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

What is the Coupon Rate? | IIFL Knowledge Center A coupon rate is the rate of interest paid on the face value of a bond, by the issuer, to the bondholder. For instance, if the 5-year bond with a face value of Rs. 100 is traded in the market at ...

![Zero-Coupon Bond: Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/28183250/Zero-Coupon-Bonds-Formula.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "39 coupon value of a bond"