44 are zero coupon bonds taxable

Zero-coupon bond financial definition of Zero-coupon bond The tax consequences of taxable issues often make zero-coupon bonds more suitable for tax-deferred accounts such as IRAs than for regular investments. Also called accrual bond, capital appreciation bond, zero. Case Study Zero-coupon bonds offer advantages, at least to some investors. Zero-coupon bonds present an investor with the certainty that ... Do you pay taxes on zero coupon bonds? - Quora Answer: Yes. When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be ...

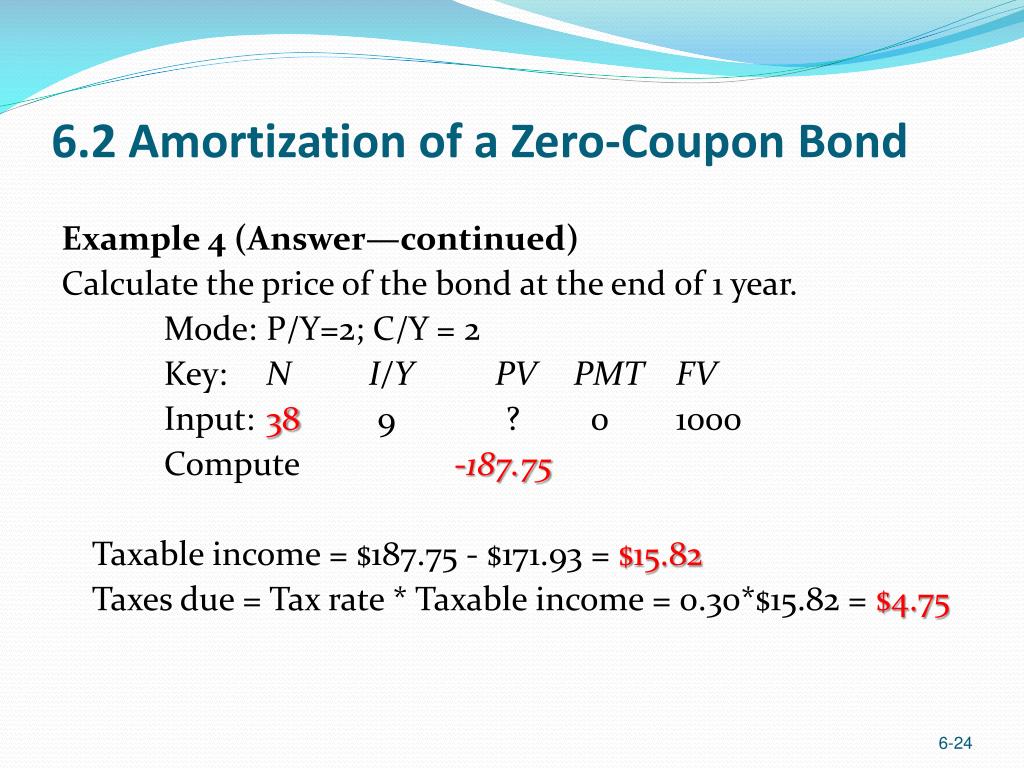

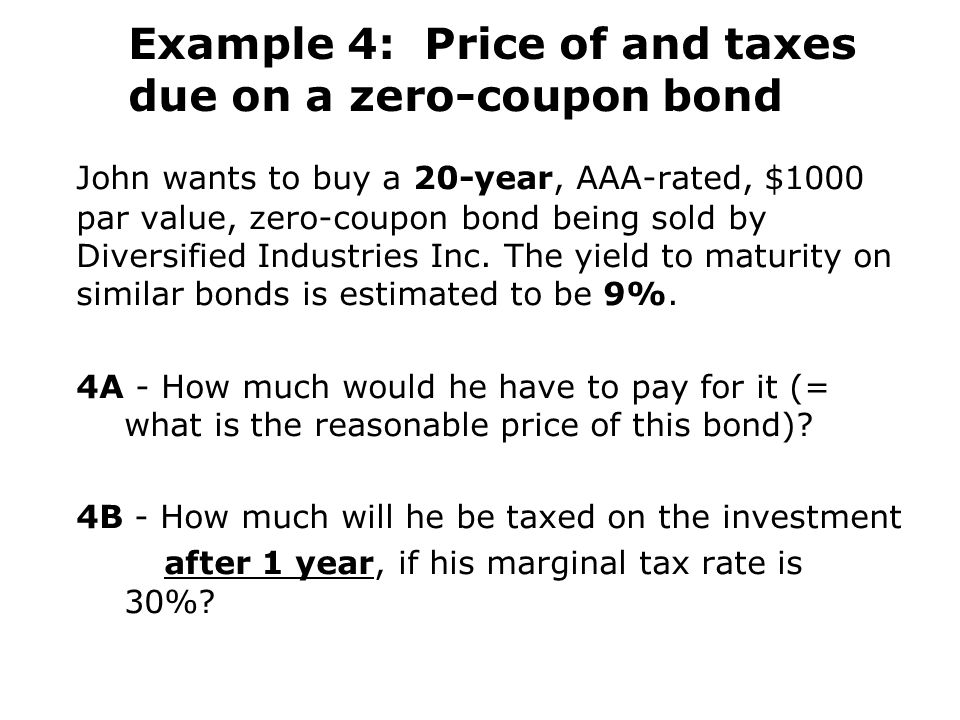

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... Mr. Tee is looking to purchase a zero-coupon bond with a face value of $50 and 5 years till maturity. The interest rate on the bond is 2% and will be compounded semi-annually. ... With zero-coupon bonds, the bondholders need to pay taxes associated with interest income, even though the particular gain has been realized or not. For example, with ...

Are zero coupon bonds taxable

› money › income-taxZero Coupon Bonds: Know tax rules when such a bond is held ... Sep 22, 2022 · Zero coupon bonds by its name clarifies that these are bonds which do not pay any interest/coupon during its tenure. ... Short term capital gains on transfer of such bonds will be taxable at the ... Tax Considerations for Zero Coupon Bonds - Financial Web Interest that is earned on municipal bonds is not taxable. Therefore, you can simply buy the zero coupon bond and then collect your interest at the end without worrying about anything in between. Education investing--When you are investing to pay for a child's education, you could put the bond in his or her name. How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

Are zero coupon bonds taxable. › fixed-income-bonds › individualIndividual bonds | Reasons to consider bonds | Fidelity A bond is an interest-bearing security that obligates the issuer to pay the bondholder a specified sum of money, usually at specific intervals (known as a coupon), and to repay the principal amount of the loan at maturity. Zero-coupon bonds pay both the imputed interest and the principal at maturity. Publication 1212 (01/2022), Guide to Original Issue Discount (OID ... It discusses the income tax rules for figuring and reporting OID on long-term debt instruments. It also includes a similar discussion for stripped bonds and coupons, such as zero coupon bonds available through the Department of the Treasury's STRIPS program and government-sponsored enterprises such as the Resolution Funding Corporation. Should I Invest in Zero Coupon Bonds? | The Motley Fool So, for instance, if you spent $750 on a 10-year $1,000 zero coupon bond, then the fact that the bond was priced to yield around 3% would mean that you'd have to pay tax on 3% of its value each ... PDF Income Taxes on Zero Coupon Bonds (Preliminary Version) payments. First the yield needs to be calculated. We will present a simplified three year zero coupon bond as an example. The taxable zero coupon bond is purchased for P = $900 with a value at maturity M = $1000 in three years. Let y = yield so that (1) 900(1 + y)3 = 1000, y = 1 1000 3 900 ªº «»¬¼ - 1 = .0357442 = 3.57442% . Next the (phantom

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds that are notified and issued by REC and NABARD are taxable. Earnings from zero coupon bonds are also subject to capital gains tax at the time of maturity. The earnings or capital appreciation for zero coupon bonds is the difference between the maturity value and purchase price of the bond. Who should invest in Zero Coupon Bonds? How is tax calculated on a zero coupon bond? - Quora Do you pay taxes on zero coupon bonds? Yes. When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax. As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond-. (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day ... Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org One last thing you should know about zero-coupon bonds is the way they are taxed. The difference between the discounted amount you pay for a zero-coupon bond and the face amount you later receive is known as "imputed interest." This is interest that the IRS considers to have been paid, even if you haven't actually received it. How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ... Tax Considerations for Zero Coupon Bonds - Financial Web Interest that is earned on municipal bonds is not taxable. Therefore, you can simply buy the zero coupon bond and then collect your interest at the end without worrying about anything in between. Education investing--When you are investing to pay for a child's education, you could put the bond in his or her name. › money › income-taxZero Coupon Bonds: Know tax rules when such a bond is held ... Sep 22, 2022 · Zero coupon bonds by its name clarifies that these are bonds which do not pay any interest/coupon during its tenure. ... Short term capital gains on transfer of such bonds will be taxable at the ...

/GettyImages-689019164-fb16a968ac1e44e69b1a7013180aba7b.jpg)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/-1000-denomination-us-savings-bonds-172745598-5ad3f176a18d9e0036be9160.jpg)

Post a Comment for "44 are zero coupon bonds taxable"