41 how to calculate coupon rate from yield

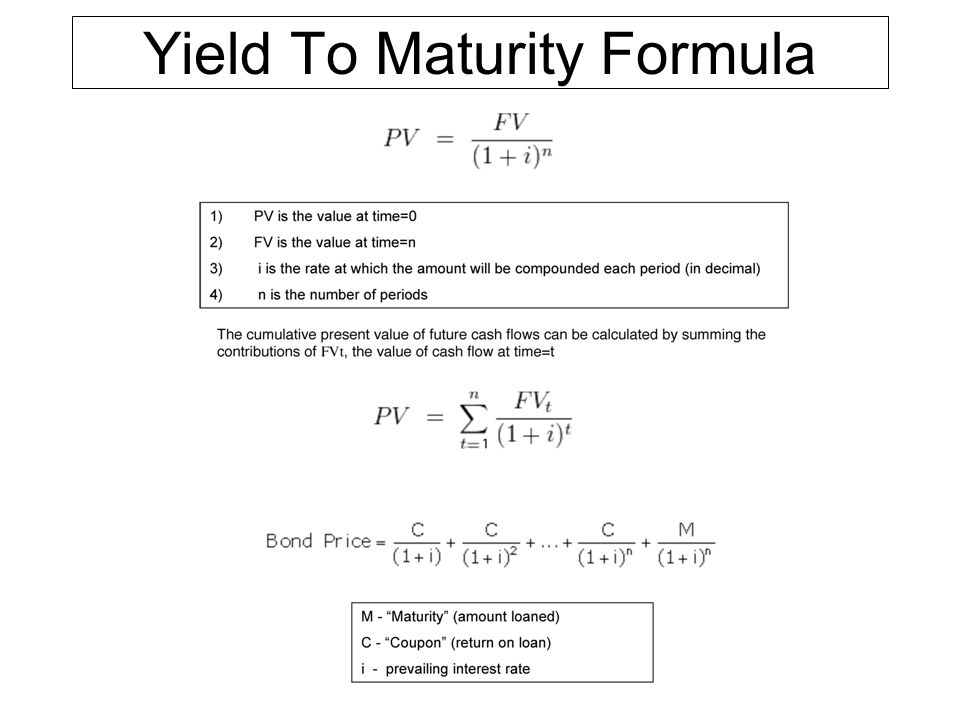

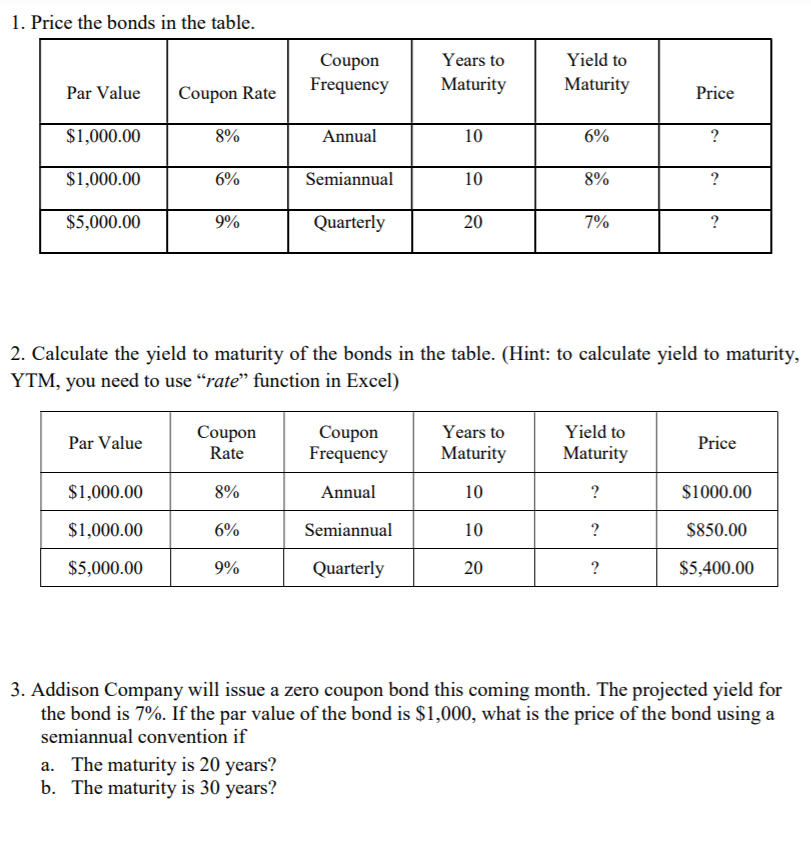

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... › Calculate-Yield-to-MaturityHow to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Estimate the interest rate by considering the relationship between the bond price and the yield. You don’t have to make random guesses about what the interest rate might be. Since this bond is priced at a discount, we know that the yield to maturity will be higher than the coupon rate.

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond.

How to calculate coupon rate from yield

› knowledge-center › how-to-calculateHow to Calculate Semi-Annual Bond Yield | The Motley Fool Nov 25, 2016 · To get an initial approximation of a semi-annual bond yield, one simple method is simply to take the coupon rate on the bond to calculate the semi-annual bond payment and then divide it by the ... Coupon Rate and Yield to Maturity | How to Calculate ... - YouTube Jun 14, 2018 ... The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated ... What is the difference between coupon and yield? You can calculate how much interest you will receive from your investment by multiplying the bond's face value by its coupon rate and then dividing by 100. For ...

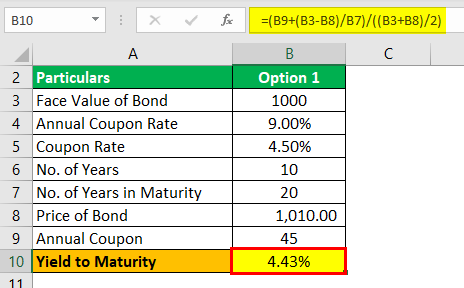

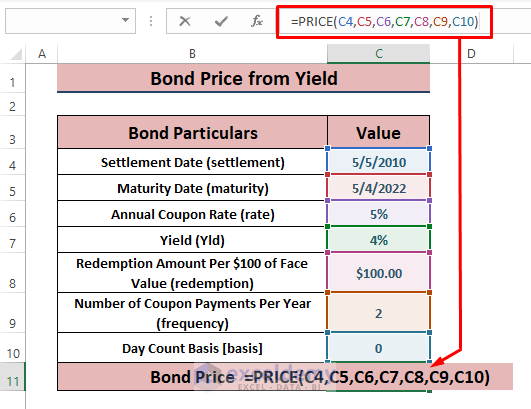

How to calculate coupon rate from yield. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube Aug 3, 2021 ... In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield ... › Calculate-Bond-Yield-in-ExcelHow to Calculate Bond Yield in Excel: 7 Steps (with Pictures) Mar 29, 2019 · Enter the following values in the corresponding cells to test the functionality of the bond yield calculator. Type 10,000 in cell B2 (Face Value). Type .06 in cell B3 (Annual Coupon Rate). Type .06 in cell B3 (Annual Coupon Rate). Type .09 into cell B4 (Annual Required Return). Type 3 in cell B5 (Years to Maturity). Type 1 in cell B6 (Years to ... Bond Yield Rate vs. Coupon Rate: What's the Difference? How Do You Calculate Yield Rate? ... A bond's yield, or coupon rate, is computed by dividing its coupon payment by its face value. An updated yield rate can be ...

Calculate the Coupon Rate of a Bond - YouTube Jul 25, 2018 ... This video explains how to calculate the coupon rate of a bond when you are ... maturity, par value, and YTM) with the bond pricing formula. Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or “par ... › ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · Find out how to use Microsoft Excel to calculate the coupon rate of a bond using its par value and the amount and frequency of its coupon payments. ... enter the formula "=A3/B1" to yield the ...

Coupon Rate Formula | Step by Step Calculation (with Examples) The coupon Rate Formula is used to calculate the coupon rate of the bond, and according to the formula coupon rate of the bond will be calculated by ... › bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. What is the difference between coupon and yield? You can calculate how much interest you will receive from your investment by multiplying the bond's face value by its coupon rate and then dividing by 100. For ... Coupon Rate and Yield to Maturity | How to Calculate ... - YouTube Jun 14, 2018 ... The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated ...

› knowledge-center › how-to-calculateHow to Calculate Semi-Annual Bond Yield | The Motley Fool Nov 25, 2016 · To get an initial approximation of a semi-annual bond yield, one simple method is simply to take the coupon rate on the bond to calculate the semi-annual bond payment and then divide it by the ...

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

Post a Comment for "41 how to calculate coupon rate from yield"